|

|||

|

Dear Friends, Hello! Thank you for subscribing to my E-newsletter. I am honored to serve the 23rd Senate District and look forward to working with you toward building a better future for Pennsylvania! This E-newsletter serves to keep you updated on what is happening throughout Bradford, Lycoming, Sullivan, Tioga and Union counties and what I am doing as your state senator in Harrisburg. I hope that you will find this E-newsletter helpful, and if you have any questions or concerns, please feel free to contact me. Gene Yaw

Click here to find the latest information on coronavirus from the Pennsylvania Department of Health and the Centers for Disease Control and Prevention Condolences… Our thoughts and prayers are with the friends and family of retired State Representative Garth Everett, who passed away last weekend at age 69. Rep. Everett represented the 84th legislative district (Lycoming County) when he served from 2007 to 2020. An Air Force veteran and Penn State Dickinson Law graduate, Garth was a tremendous lawmaker and a good friend. In The News…Promoting College and Career Savings Program…PA Treasurer Stacy Garrity, Senator Yaw and Center for Rural Pennsylvania Announce Findings of PA 529 Report. Protecting Those Who Protect Us…Senator Yaw Sponsors Bill Limiting Firefighter Exposure to PFAS, Safeguarding Environment Reintroduced in New Legislative Session. Investing in Our Youth…The First Community Foundation Partnership of Pennsylvania Announced 80+ Scholarships are Available to Students in Bradford, Clinton, Columbia, Lycoming, Mifflin, Montour, Northumberland, Sullivan or Union Counties for the 2023-2024 Academic Year. $1 Million in Funding Available for Security Enhancements…PCCD Announces Launch Of Nonprofit Security Grant Fund Program Solicitation. Ready! Set! Write! Grant Writing from A to Z…The Pennsylvania Office of Rural Health is offering a grant writing series from March 2 to April 13, 2023. The four-part series is designed for both new and seasoned grant writers, as both will find valuable information and resources to enhance their skills. Celebrating the Troy Sale Barn’s 100th Anniversary Today, I had the honor of recognizing the Troy Sale Barn and its membership on the momentous occasion of its 100th Anniversary. One hundred years ago, 20 farmers met at the Troy Hotel and organized the Bradford County Livestock Sales Association to help farmers sell their livestock. On April 10, 1920, construction on the sales pavilion began. The amphitheater-style building held its first livestock sale on June 3, 1922 and was the economic center of Troy, bringing much business to this Bradford County community. The Troy Sale Barn has come a long way in the past 100 years, all thanks to the volunteers who spent many hours doing barn renovations and their visionary leadership to make the Barn a sustaining venue. TUNE-IN: Senator Yaw Joins The Labor Show on 1210 WPHT Saturday

Cutters Director of Smiles Joins Bowman Field Hall of Fame

Rhashan West-Bey, the Williamsport Crosscutters Director of Smiles, was recently inducted into the Bowman Field Hall of Fame at the Cutters 2023 Hot Stove Banquet in Williamsport. I was pleased to recognize this wonderful accomplishment. In this photo provided by the Williamsport Crosscutters are L to R: Lou Hunsinger, Jr, Chairman of the Bowman Field Commission; Doug Estes, Williamsport Crosscutters Vice President General Manager; West-Bey, Williamsport Crosscutters Director of Smiles; Matt Wise, my District Director; and Gabe Sinicropi, Williamsport Crosscutters Vice President of Marketing. Voter ID: Time for PA to Catch Up with Other States, Nations

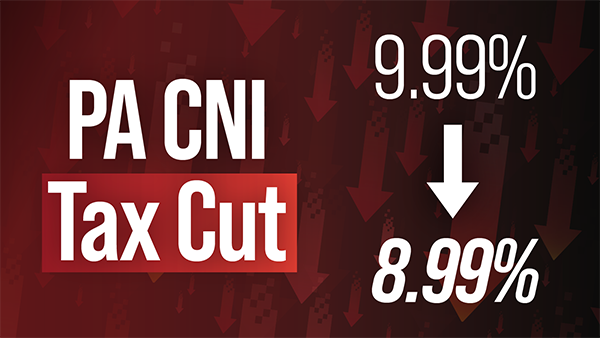

A proposed constitutional amendment passed by the Senate earlier this month to require ID verification at polling places remains in the House of Representatives. Its approval is needed to let voters have a say through a ballot question in the spring primary election. Pennsylvania’s failure to enact this key component of election integrity has put it behind not only a vast majority of states and most developed countries, but behind many developing nations as well. Every excuse used to block this rational election reform has been shown to be false. Requiring proof of identification before voting does not suppress turnout, and acceptable IDs are not difficult to obtain. Nationally, the calls for voter ID come from Democrats and Republicans alike. Eighty percent of Americans favor voter ID as do 74% of Pennsylvanians. Now is the time to pass Senate Bill 1 and let the voters decide. Restoring Checks and Balances in Pennsylvania Government In addition to letting citizens decide whether voters should be required to show ID, Senate Bill 1 includes a proposed constitutional amendment allowing the people’s representatives in the General Assembly to overturn any government regulation that conflicts with the will of the people. The need for this change was made clear by the Wolf administration’s unilateral decisions during the pandemic, closing businesses and schools with no input from the people. Despite the clear design of our government with three co-equal parts, the executive branch elevated itself above the legislative and judicial branches in an obvious violation of the checks and balances afforded by the Pennsylvania Constitution. No governor of any party should be permitted to wield such unchecked power again. If the House of Representatives follows the Senate’s lead and passes Senate Bill 1, voters will be empowered to restore this crucial balance of power. Phase-out of Job-Killing PA Tax Begins The phase-out of Pennsylvania’s sky-high Corporate Net Income tax got underway this month, part of our efforts to keep good jobs here and create new ones. Republican lawmakers secured a cut in this job-killing tax as part of the 2022-23 state budget. Before this reduction to 8.99%, Pennsylvania’s CNI tax had been 9.99% for nearly three decades while other states had lower tax rates – some far lower – and many have been lower for almost as long. When gradually reduced to 4.99% in 2031, Pennsylvania’s CNI rate will have gone from one of the highest in the nation to one of the lowest, making the commonwealth far more competitive with other states. A 2009 report by an economist at the Federal Reserve Bank of Kansas City demonstrates that the burden of the corporate income tax is borne in large part by labor within the state in the form of lower wages. A 2016 paper published in the journal American Economic Review found employees shoulder about a third of the corporate tax burden. Reducing this tax will be the difference between jobs coming to our local communities and jobs leaving. This will be a great benefit to Pennsylvania families. Rebates for Property Taxes and Rent Available to Seniors, Pennsylvanians with Disabilities

Older adults and Pennsylvanians with disabilities can apply now for rebates on property taxes or rent paid in 2022. The rebate program benefits eligible Pennsylvanians age 65 and older; widows and widowers age 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 a year for homeowners and $15,000 annually for renters, and half of Social Security income is excluded. Spouses, personal representatives or estates may also file rebate claims on behalf of claimants who lived at least one day in the claim year and meet all other eligibility criteria. The maximum standard rebate is $650, but supplemental rebates for qualifying homeowners can boost rebates to $975. You can find more eligibility and application information here. Eligible applicants can visit mypath.pa.gov to electronically submit their applications. Local Organizations Can Apply Now for Conservation Grants Counties, municipalities and municipal agencies, pre-qualified land trusts, nonprofits and other eligible organizations can apply now for state conservation, recreation, trail and related grants. Administered by the Department of Conservation and Natural Resources, the Community Conservation Partnerships Program is funded with a variety of state and federal funding sources including Pennsylvania’s natural gas Impact Fee. Applications will be accepted through April 5. Online tutorials are available to aid organizations in the application process. |

|||

|

|||

Want to change how you receive these emails? 2025 © Senate of Pennsylvania | https://www.senatorgeneyaw.com | Privacy Policy |